Key figures

Profit after tax

4,344 NOK million

Hydropower production

13.8 TWh

Greenhouse gas emissions

459,554 tCO₂e

Sorting rate

89 %

Number of employees

686

Number of injuries

2.9 per million hours worked

| NOK million | 2022 | 2021 |

|---|---|---|

| FINANCIAL KEY FIGURES | ||

| Revenues and other income | 22,028 | 10,847 |

| EBITDA | 20,087 | 8,979 |

| Operating profit (EBIT) | 19,340 | 8,463 |

| Underlying operating profit | 19,914 | 9,678 |

| Profit before tax | 18,879 | 7,901 |

| Profit after tax | 4,344 | 2,611 |

| Net interest-bearing debt | 9,523 | 11,336 |

| -of which subordinated debt | 7,338 | 5,264 |

| Total assets | 97,265 | 63,584 |

| Capital employed | 65,609 | 43,046 |

| Investments in operating assets | 870 | 590 |

| ROE (%) | 12.5 % | 9.9 % |

| ROCE (%) | 35.6 % | 19.2 % |

| Net interest-bearing debt/EBITDA (x) | 0.5 | 1.7 |

| FFO/Net interest-bearing debt (%) | 141 % | 54 % |

| Equity ratio (%) | 44 % | 42 % |

| Other key figures | 2022 | 2021 |

|---|---|---|

| Number of employees | 686 | 438 |

| Turnover (voluntary termination) | 3.6% | 2.5% |

| Number of injuries per million hours worked (H2) last 12 months | 2.9 | 6.9 |

| Greenhouse gas emissions (Scope 1, 2 and 3) (tCO2e) *) | 459,554 | 3,573 |

| Hydropower produced (TWh) | 13.8 | 18.3 |

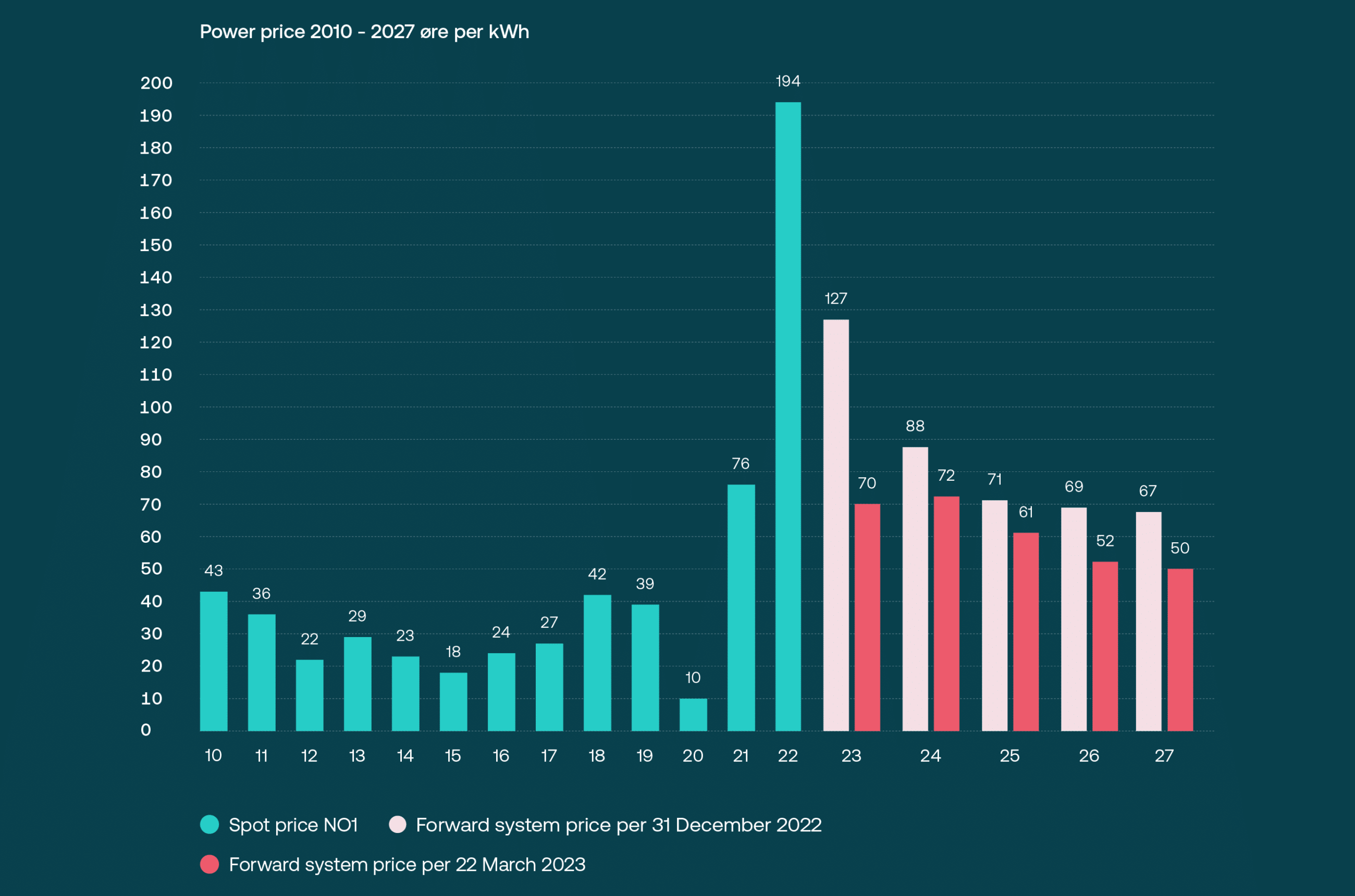

| Achieved power price (øre/kWh) | 150 | 62 |

| Nordic system price (øre/kWh) | 137 | 63 |

| Heat sales (GWh) | 761 | N/A |

*) The climate emissions include market-based emissions in scope 2. The 2022 figures include an expansion of scope 3 emissions and climate emissions from Hafslund Oslo Celsio, while the 2021 figures exclude Hafslund Oslo Celsio and only include very limited scope 3 emissions.